actual vs official rate of inflation (CPI), per ShadowStats

In the first part of this article I attempted to explain how and why what I call Extinction Capitalism arose, and why it will inevitably lead to global economic collapse. In this second part, I take as stab at guessing what will happen in the next decade.

Forecasting is inherently precarious, and like many forecasters I have a very human tendency to overestimate how quickly things will change, even though my predictions of the end result have been accurate.

I’m going to frame this in the context of my personal situation, just to make it a little less dry. My situation is that I am somewhat comfortably retired on a defined-benefit pension, but I live on a fixed income, and I’m a tenant — I deliberately decided a decade ago to get off the real estate merry-go-round, so I own very little. My net worth is about 18 months’ pension. I’m 70.

When people have to face a whole series of crises one after another, the effect is to keep everyone off-kilter. If we had time to think and organize to respond to dysfunction, we might (it’s debatable) be able to rise up and make significant changes to our political and economic systems to reduce that dysfunction, at least making the crises a bit easier to bear.

But, like in the 1930s, we seem to be entering a time when there is no time to think and organize and change things before the next crisis is upon us. The pandemic, and weather-related emergencies (forest fires, hurricanes, floods, droughts, and other extreme weather events) keep pushing more existential crises like ecological and climate collapse onto the back burner. Chronically poor education and information systems, and large-scale misinformation and disinformation by vested political and economic interests, seriously aggravate our capacity to respond to such challenges. In many places, inadequate, thinly-stretched health care systems, combined with an epidemic of “lifestyle” chronic diseases, exacerbated by the dismal state of public health and nutrition in much of the world, rich and poor, are also taxing and threatening to break these systems.

So our resilience is low — perhaps, due to our utter, global dependence on centralized systems, it’s as low as it’s ever been in history.

Against this backdrop, here is what I think we will have to face in the coming decade:

- Continuing acceleration of inequality of wealth and income, to historic highs. The already thinned-out middle class will more or less disappear as the line of affordable living moves ever northward and the median income relative to cost of living moves inexorably southward.

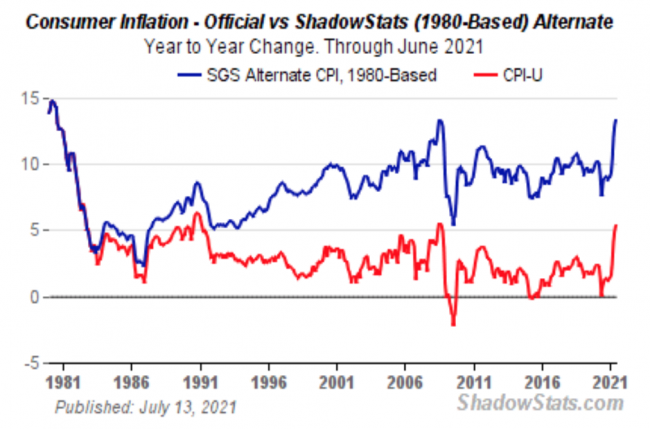

- Inflation, which is already at about 10% (ie doubling living costs every seven years, as housing and health care costs have done) will increase to over 15% as the demand for ever scarcer and more precarious resources increases with population and growing needs. Governments have consistently lied about inflation (see chart above) since the Reagan years “recalculated” it, so even the “official” inflation numbers, currently pronounced as about 5%, will at least double to the point the government can’t completely ignore them.

- The doubling or more of consumer costs over the next decade will increase, by a factor of at least five, the number of people on fixed incomes at or below the poverty level. Many of these will be seniors, and many will be young people who never “got into” the markets and whose wages from their low-paying, ever-precarious jobs will increase much more slowly than actual inflation.

- At least in cities, the proportion of “single-family” dwellings will plunge, as most such homes (except those of the 1%) are converted into two-family and three-family dwellings, often with second “accessory dwelling units” or “carriage houses” added on the same property.

- Our economy depends utterly on the extraction and use of ever accelerating amounts of hydrocarbons. Governments and corporations will keep lying about the potential of renewables, which, even with vastly improved (as yet non-existent) technology, will never meet more than 15% of our energy needs, and developing them will also require hydrocarbon energy. But although peak affordable oil has already passed, governments, corporations and OPEC will keep increasing the available supply even as affordably-extractable reserves collapse over the next decade. We are going to see a ghastly oil crash, but it may be pushed back to the next decade, when the current crop of politicians and executives will have retired to their mansions in Hawai’i and New Zealand.

- You know what comes with this, of course — as we keep drilling, fracking and pumping, atmospheric carbon levels will continue their ascent, easily surpassing 450 ppm CO2 by 2031. The CO2e numbers, as other greenhouse gases like methane begin to kick in in larger proportions, will be even worse. This means a locked-in 4-6ºC rise in global mean temperature perhaps as soon as mid-century, and runaway climate change for millennia thereafter. The door to action has closed, and it is possible that ten years from now it will dawn on a significant proportion of the population that endgame is in sight, and that our whole way of life will soon drastically and permanently change.

- Everything, in terms of economic collapse, depends on when this realization enters public consciousness. My guess is that this is less than 50% likely to happen in the next decade. We don’t want to hear it, or believe it, and we lap up denier proclamations and assurances that there is or will soon be a techno-fix, or a coordinated global humanist fix, if only we…

- What do you do once you realize that your real estate, your home, your pension, and your stocks and bonds will lose much or most of their value by mid-century, and perhaps much sooner? If you have any debts securing them, you’ll likely liquidate the assets to get rid of the debt, and then sit tight as your net worth collapses but your now debt-free remaining property is still yours. And you’ll probably liquidate all your stocks and other investments that are dependent on “growth” for their value. I thought that would have happened by now, but my best guess now is around 2029-2032. The coincidence of those dates is not lost on me. In 1921 no one thought 1929-32 would happen. No one.

- More than half of the people in most countries have a zero or negative net worth, and that proportion will jump over the next decade. As interest rates rise with inflation, many of these people will be forced into bankruptcy. The first to go will be foreclosed on, and many of them will end up on the streets, unhoused. Most of the rest will probably hang on for this decade, and by the time they go under, banks will be suspending payments on mortgages because they won’t be able to sell the properties anyway. Just like a century ago. But I’m getting ahead of myself. That’s the nextdecade.

- Unemployment is hard to measure, not only because the government lies about these numbers as well, but because people tend to do whatever they have to, including working multiple jobs, to keep the wolves from the gate. What is almost certain, though, is that (1) a large percentage of people will be working two or three jobs, and working 60-80 hours a week, as is already the case in struggling nations and in many tourist and service-economy areas; and (2) a large percentage of the population will be unemployed, unemployable, and become part of the unnecessariat, as more and more economic activity becomes self-serve and automated. That proportion is already 25-35%, as ShadowStats suggests, and will inexorably grow as the DIY economy grows, and as the rest of the economy slumps.

- There will be more pandemics, and not only human ones, but pandemics affecting CAFO factory farms (especially poultry), and monoculture crops. Current trends suggest another major one, and one or two lesser ones, in the decade to come.

So those are my predictions. What is probably more important is how we will respond to these changes. Will we be like the boiling frogs, not noticing things getting slowly worse until it’s too late, or will we react, and force governments and corporations to respond?

I don’t think we, or governments or corporations, will do anything significantly different until/unless there is no alternative. But these intriguing actions are possible, maybe even likely, in the next decade:

- Slow phase-in of a guaranteed annual income (GAI). This was unthinkable before the current pandemic, but I think it’s an idea with legs. For a start, corporations don’t want massive bankruptcies — broke people don’t buy stuff. With less and less of the population physically and emotionally able to work, and fewer and fewer real jobs, most requiring advanced skills few people have, the only way to keep the whole population engaged contributing to the consumer economy is to give them money to buy stuff. Expect trials first, then states taking the lead, and then gradually it being integrated into the tax system.

- A real minimum wage. This will have to be significantly higher than the GAI. I think it will come, as inflation grows and more and more get fed up with 80-hour weeks. It will force corporations to the next stage of automation — getting rid of a lot of middle-management pencil-pushers and other Bullshit Jobs, so they can afford the new minimum wage for people who actually do something.

- Actual tax increases on the rich. The naked emperor can only fool the citizens so long. They’ll try to make it a global tax schema, and about “fairness”, but eventually many countries will go it alone anyway. It’ll be gradual, but once it’s become legit and no longer political suicide, it will gain momentum.

- Slashes to military spending. The bloated, unaccountable spending for war by governments has passed the breaking point. Everyone knows it. The British, in the same situation a century ago, had to slash war spending because their empire was just too expensive to maintain. Like tax increases on the rich, this will be tough at first, and violently opposed, but will gradually become common wisdom as a necessary move.

- A health care nightmare, and not just in the US. As the population everywhere ages and sickens, all of the current systems are unsustainable. There are no obvious answers. Simple implosion of the system in some countries is possible. If not, there will have to be limits on the rights, even of the rich, to unlimited health care. It’s probably going to be nastier than anything else we see in the next decade.

- Price controls on selected essentials. By which I mean essential to short-term economic stability, not essential to public health and well-being. Petrochemicals (with offsetting subsidies to producers so they keep producing), electricity, pharmaceuticals, rents, maybe even internet prices. Every commodity has a supply/demand curve, and when they no longer intersect, which will be the case for more and more things, controls will need to be imposed.

- A partial debt jubilee: There is a long and glorious tradition of such jubilees (blanket forgiveness and erasure of debts), but recent, fierce new restrictions on the capacity to declare personal bankruptcy in some countries has shown an inclination for the opposite. It can’t continue; you can’t get blood out of a stone. Governments will have to step in, take over and write off several types of egregious debts, starting with student loans and then “underwater” mortgages (of which there will be many more when the real estate bubble bursts, which will likely happen several times over the next decade). As usual, the banks will remain unpunished for their risky lending practices. The taxpayers will pay for the bailouts.

- No ban on evictions. While underwater homeowners will get some debt relief, renters will be largely left to their own resources. The rental market will play out accordingly. Expect the cities to continue to hollow out of workers, and stores and restaurants especially in major city centres to get more expensive to pay minimum wages; they will accordingly aim for a more upscale market. This is already happening in some places.

- No better preparedness for pandemics. We seem to have learned nothing from the current one, so expect the next one to be equally mismanaged. We just aren’t cut out for dealing with this type of crisis.

- No revolution. During the Great Depression, the top 5% did fine despite tax rates as high as 90% and plummeting stock and real estate values. Debt-free, they just sat on their assets until it was over. But the next 20% were hit as hard as everyone else, and it was a long and hard fall for them. There were protests, but most people just struggled, took their licks, and soldiered on, convinced their woes weren’t special and everyone was in the same boat. My guess is that’ll be the case as things get more dicey this decade — much noise and complaint and blame, but not much direct action. Most of the actions above will be taken by governments who are forced to the wall by harsh economic realities, rather than being pressured by citizen unrest. Things have to get really bad before humans tend to take to the streets and the barricades.

I will probably be proved wildly wrong in these predictions, but it will be interesting to see. It’s going to be an eye-opening decade, but denial will prevail for this decade at least. It was 1933 before it was officially labelled The Great Depression, and it might be 2033 before it dawns on most of us that the great experiment with Extinction Capitalism was a well-intentioned but ultimately disastrous experiment, and that economic collapse will be but the first phase of a more complete, and permanent, civilizational collapse, over several more decades. No predicting what will happen then.